Simplifying your financial journey, every step of the way!

From day one, we’ve been on a mission to make managing money simpler and more affordable. Being in business for 20 years now and with a growing community of happy clients, we can safely say that we have the experience and the know-how for our clients to succeed anywhere, anytime. Our private and business clients enjoy fast, secure, and fairly priced financial services, including international transfers, currency exchange, and more.

With the right tools, everyone can manage finances efficiently!

Our Mission

Our Vision

Now we’re a global player, with even more to offer

We’ve come a long way since 2004. What started with just 3 employees has now grown into a team of over 700 professionals working in more than 30 countries.

Our mission has also driven us to build a strong network of reliable partners, and it’s allowed us to expand our range of services.

Today, we offer more than just convenient international transfers. Our solutions now cater to event organisers, physical retailers, e-shops, and private clients. With just one account, our clients get endless possibilities.

Management

More information at: LinkedIn

Shareholders of the Company

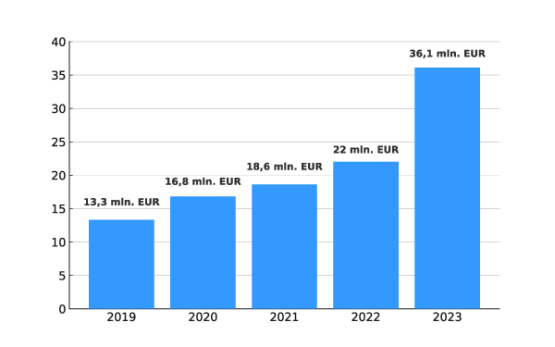

Our growth

In 2024, our clients performed more than 10.6 m transfers in 20+ different currencies. The total amount transferred exceeded 12.1 bn EUR.